AI-Powered Solutions for Banking & Finance sector

Transform your banking institution with intelligent vision technology that goes beyond traditional security – delivering deeper insights.

Banks and financial companies face big challenges every day. Those challenges are spotting fraud, keeping up with rules, and building customer trust. WebOccult offers intelligent banking solutions using AI in banking and computer vision to make things faster, safer and smarter.

Our tools help with banking fraud detection, fraud prevention in banking, and financial fraud detection in real time. We also support automated KYC processes, anti-money laundering and banking compliance solutions to help banks stay secure and follow regulations. We improve banking risk management and offer complete fraud solutions for banks with our fraud detection tools in banking.

Our AI tool checks signatures fast and accurately. It spots fake ones, tracks changes over time, and helps stop fraud. This smart banking security technology speeds up checks and adds strong fraud detection solutions to your system.

Convert mountains of paperwork into streams of data with our intelligent document processing solution. Our advanced OCR system transforms document processing from a manual burden into an automated breeze, cutting processing time by 90% while maintaining 99.9% accuracy. Financial institutions now turn stacks of forms into structured data instantly, making information not just accessible but actionable.

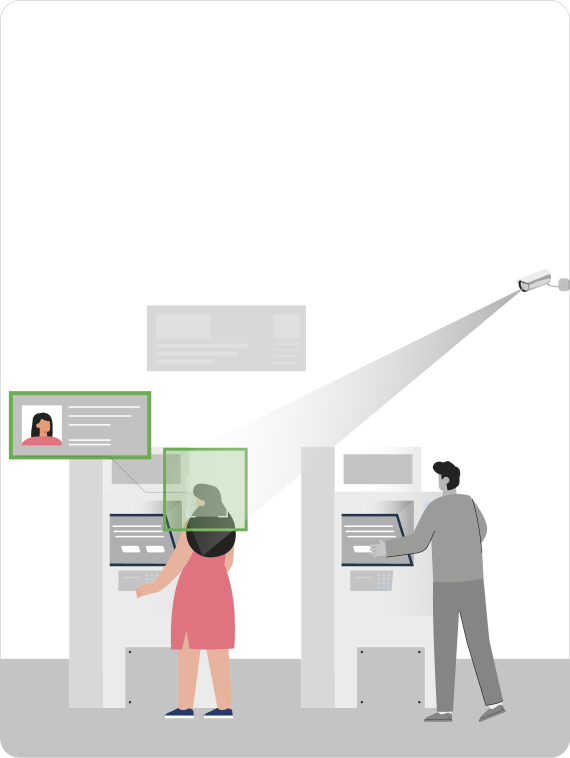

Revolutionize customer onboarding with AI that turns hours into minutes. Our computer vision system transforms KYC from a paperwork marathon into a digital sprint, slashing verification time by 85% while enhancing fraud detection accuracy to 99.8%. Banks now convert lengthy manual checks into instant verifications, delighting customers and strengthening compliance.

Turn transaction monitoring from reactive to predictive with our AI-powered AI&ML solution. Our system transforms complex pattern detection into automated intelligence, identifying suspicious activities 200x faster than traditional methods with 99.6% accuracy. Financial institutions now spot money laundering schemes before they take root, converting compliance challenges into confidence.

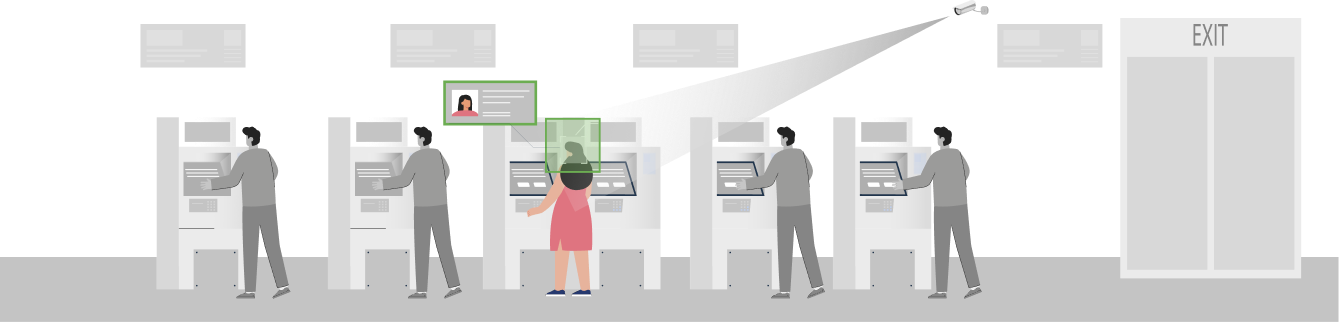

Transform security from passive surveillance to active prevention with our intelligent monitoring system. Our computer vision solution turns standard cameras into crime-stopping sentinels, reducing theft incidents by 75% while providing real-time threat detection. Banks now convert traditional security measures into predictive protection protocols.

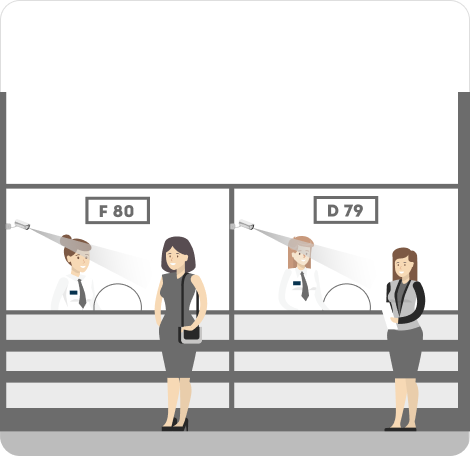

Convert foot traffic into actionable insights with our AI-powered staff optimization system. Our solution transforms workforce management from guesswork to precision, reducing wait times by 60% while improving customer satisfaction by 45%. Banks now turn customer flow patterns into optimal staffing strategies.

Revolutionize facility security with biometric precision that never blinks. Our advanced access control system transforms traditional entry points into intelligent security checkpoints, processing authentications in under 2 seconds with 99.9% accuracy. Banks now convert vulnerable access points into fortified, yet frictionless, entry systems.

Transform transaction monitoring from guesswork to guarantee with automated systems that catch what human eyes miss.

Master the matrix of threats with AI-powered surveillance that spots suspicious patterns before they become problems.

Bridge the gap between suspicious activity and confirmed fraud with concrete data that turns hunches into hard evidence.

Tailor-made Computer Vision solutions that turn surveillance footage into fraud prevention, without turning banks into tech companies.

Our vigilant AI cuts fraud incidents to below 0.1%, because in banking, every transaction must be bulletproof – literally.

Automated systems process documents 20x faster than traditional methods, because time saved on verification is money earned in satisfaction.

Live monitoring that turns suspicious patterns into preventive actions, empowering decisions that don’t just protect but profit.

Slash fraud losses by 30% while boosting compliance accuracy to 99.9%. Because smart security should protect both assets and profits.

Turn your banking space into a fraud-proof powerhouse. Let us show you how AI transforms traditional security into strategic advantage. Schedule your private consultation now.

AI is secure when properly built and monitored. But like any tech, it needs protection from cyber threats.

AI quickly scans large data to spot issues, reduce human error, and keep up with changing rules.

Yes. AI detects patterns and risks much faster than manual systems, helping prevent problems early.

AI makes data analysis faster, more accurate and can reveal insights your team might miss.

It compares signatures in real time to detect fakes and prevent unauthorized access or fraud.

Stay updated with the trending and most impactful tech insights. Check out the expert analyses, real-world applications, and forward-thinking ideas that shape the future of AI Computer Vision and innovation.

Fraud is on the rise, everywhere from individuals to businesses. It affects both businesses and everyday people. From identity theft to financial schemes, criminals keep finding fresh ways to exploit loopholes. Thankfully, technology is also moving forward to counter these threats. One of the strongest tools in this battle is AI, especially AI computer vision. […]

CEO & Co-founder